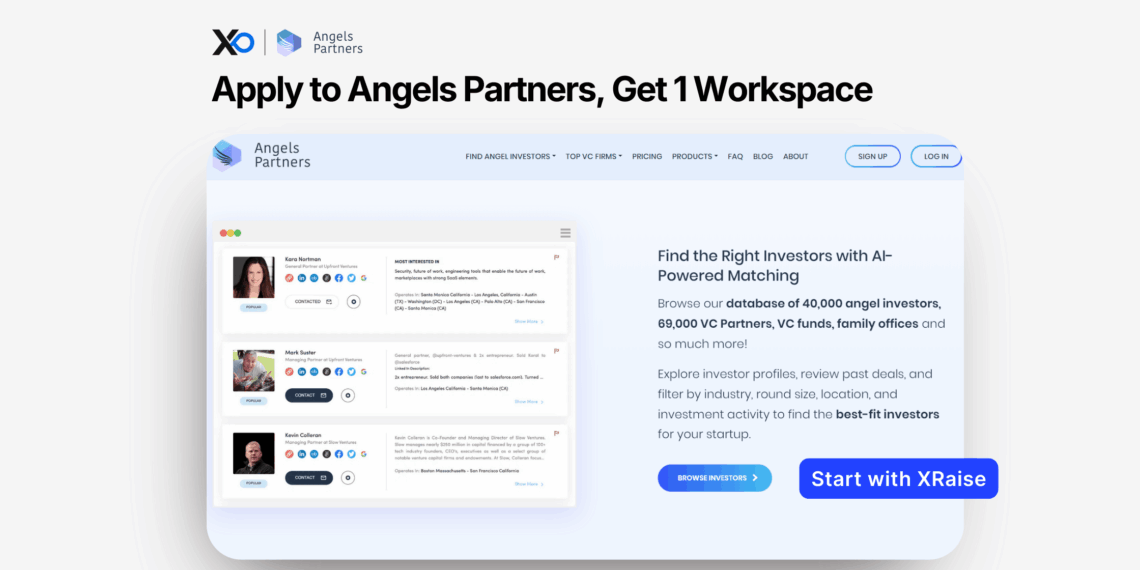

Angels Partners for Startups gives founders one place to run investor outreach, follow-ups, and deck engagement tracking.

If you want a single fundraising workflow instead of scattered tools, Apply for Angels Partners on XRaise and keep the entire raise organized.

TL;DR

This guide explains how the Angels Partners for Startups perk works, so you can run a real investor outreach system (not spreadsheets) while keeping your fundraising process consistent from first message to booked meetings.

- Replace fundraising spreadsheets with one workflow: a fundraising workspace helps you track investors, outreach, and follow-ups in one place.

- Write stronger outreach faster: AI messaging tools help you draft and refine investor messages without starting from scratch.

- Prioritize the right follow-ups: secure document sharing and engagement tracking help you see who’s viewing your pitch materials.

- Use XRaise to apply for the perk and keep your perks stack organized, then check the official vendor page only for details/terms.

What is Angels Partners for Startups?

Angels Partners for Startups is a fundraising platform that helps founders organize investor outreach and manage fundraising like a pipeline, not a spreadsheet.

In plain terms, it replaces:

- a list of investors in Sheets

- outreach drafts in your notes app

- follow-ups buried in email threads

- separate deck links with no visibility into who actually opened them

Instead, it gives you one dashboard to track who you contacted, what you sent, what happened, and what to do next.

If you’re building a repeatable fundraising motion, this is the kind of system you want in place before your outreach volume ramps up.

What do you get with the Angels Partners perk?

The perk includes access to Angels Partners subscription plans designed for fundraising workflows. Based on the perk details, features include:

- Fundraising workspace to manage investors, outreach, and follow-ups

- AI messaging tools to draft and improve investor outreach

- Document sharing + engagement tracking for pitch materials

- Access controls for shared documents (verification and revoking access)

- Plans designed for different outreach volumes

For official plan structure (including outreach volume limits), check the vendor’s pricing/terms page for confirmation only.

Before you apply for Angels Partners: who is eligible (and who isn’t)?

This perk is positioned for founders who are actively fundraising or about to start.

Usually a strong fit if you are:

- Pre-seed or seed and setting up your first repeatable fundraising process

- Running high-volume outreach (or planning to)

- Sharing a deck and wanting engagement analytics so you can prioritize follow-ups

- Coordinating fundraising with a co-founder and needing shared visibility

Common reasons it may not be worth it right now:

- You’re not fundraising for the next 8–12 weeks

- You only need a basic contact list, not a full fundraising workflow

- Your outreach is extremely low-volume and you won’t use tracking features

Eligibility notes

If you don’t see explicit requirements on the perk page or in the application flow, assume:

- Varies by plan/region

- Not publicly confirmed

…and rely on the official vendor terms where needed.

If your goal is to move fast and keep the process tight, consider running outreach as a sprint instead of an open-ended raise, see here.

Apply for Angels Partners on XRaise (step-by-step)

Use this exact sequence to keep the process simple and avoid back-and-forth.

- Open the perk page on XRaise.

- Click the apply/claim action on the page (button text may vary).

- Sign in (or create your XRaise account) so your application is attached to your founder profile.

- Submit the requested company details and any context fields (only what the form asks for).

- Confirm submission and note any follow-up instructions shown immediately after applying.

- If verification is requested (company domain, identity, or other checks), complete it quickly to avoid delays.

- Watch for approval/next-step instructions from XRaise.

- After approval, activate access exactly as instructed. Confirm plan limits and policies on the vendor’s official pages if needed (terms only).

Apply for Angels Partners: what to prepare before you submit

Only prepare what’s relevant to your fundraising workflow:

- your current fundraising stage (pre-seed/seed, etc.)

- your deck link (if you’re already sharing it)

- your target investor profile (even a rough version)

- your follow-up cadence (how often you’ll send updates)

This keeps your Angels Partners application clean and helps you start using the system the moment you’re approved.

What it’s worth in practice (no made-up math)

The value is operational: fewer missed follow-ups, clearer prioritization, and less fundraising chaos.

Scenario 1: You’re building your first “real” outreach loop

A fundraising CRM matters once you move beyond a handful of warm intros. The moment you’re sending consistent outbound messages, follow-up tracking becomes the difference between “we tried” and “we booked meetings.”

Scenario 2: You’re sharing a deck but can’t tell who’s engaged

Engagement tracking lets you focus on the investors who are paying attention. That changes how you follow up: more direct, more timely, and more relevant.

If you’re specifically comparing “deck tracking” workflows, docsend for startups is a useful reference.

Scenario 3: You’re fundraising while shipping product

Fundraising competes with execution. A single dashboard reduces switching costs: you open one place, see your pipeline, and take the next action.

Scenario 4: You have multiple people touching the process

When a co-founder or teammate helps, you need one source of truth: who contacted whom, what was said, and what’s next. That prevents duplicate pings and missed responses.

If you’re ready to Apply for Angels Partners, these are the exact situations where you’ll feel the difference quickly.

Tips to maximize approval and value after you apply for Angels Partners

A tool doesn’t fix fundraising. A tool plus discipline does.

Use these tactics:

- Start with a clean investor list. Even 30-50 targets is enough to begin.

- Write one outreach message and iterate. Don’t freestyle every email.

- Set a follow-up schedule. Make it predictable (e.g., day 3, day 7, day 14).

- Use engagement signals to prioritize. Follow up harder where attention exists.

- Keep your deck link consistent. Don’t confuse tracking by sending multiple links without a plan.

If follow-up discipline is your weak point, folk for startups is worth reading:

Alternatives to Angels Partners (if your needs are narrower)

Keep this short and practical.

- Spreadsheet + strict cadence: works only if you already have strong follow-up discipline.

- Deck tracking tool + separate CRM: if your main pain is deck engagement visibility.

- Lightweight relationship CRM: if you’re early and not running high-volume investor outreach yet.

If you want a broader “application strategy” mindset for 2026, check startup accelerators 2026 – smart way to apply.

FAQ: Apply for Angels Partners (and common founder questions)

How do I apply for Angels Partners?

Apply on XRaise using the perk page.

What do I need to qualify?

Submit the details the application asks for. If eligibility requirements aren’t displayed, they’re Not publicly confirmed and may vary by plan/region.

Does Angels Partners take equity or a success fee?

The vendor states they do not take equity or a fee on funds raised (confirm on official terms).

Can I track investor engagement with my pitch deck?

Yes. The perk description includes document sharing and engagement tracking for pitch materials.

Can I stack this with other offers?

Not publicly confirmed. Assume stacking depends on the vendor’s official terms and the perk’s activation rules.

What happens after the perk expires?

Not publicly confirmed in the provided details. If the benefit is time-bound, expect to revert to standard pricing unless stated otherwise in your activation terms.

Is this worth it if I’m only contacting a few investors?

If outreach is low-volume and you won’t use tracking, a simpler workflow may be enough. Angels Partners makes more sense when you’re running consistent outreach and follow-ups.

Final Thoughts

If fundraising is on your calendar, the goal is not “more tools.” The goal is a clean pipeline, reliable follow-up, and visibility into engagement so you can prioritize the right investors.

Angels Partners for Startups gives founders one place to run investor outreach, follow-ups, and deck engagement tracking.

Apply for Angels Partners on XRaise.