This week, U.S. startup accelerators and seed-adjacent players stopped selling “community” and started shipping mechanics: new payout rails, explicit investor access, and tighter check math.

TL;DR

- The week’s signal: U.S. startup accelerators are moving from vibes to ops, funding rails, credits, and distribution are getting productized.

- Breakthrough Ventures raised $2M to back student founders with grants, compute credits, and a follow-on option.

- YC says Spring 2026 startups can take the standard check via stablecoins (reported as USDC) on major chains.

- Morgan Stanley’s MSISV ran its global demo day (300+ investors) and opened applications through March 31.

- LearnLaunch opened Breakthrough to Scale applications for traction-stage edtech with a $50k initial investment.

- SNAK closed an oversubscribed $50M debut fund to write $1M–$2M seed checks into B2B/vertical marketplaces.

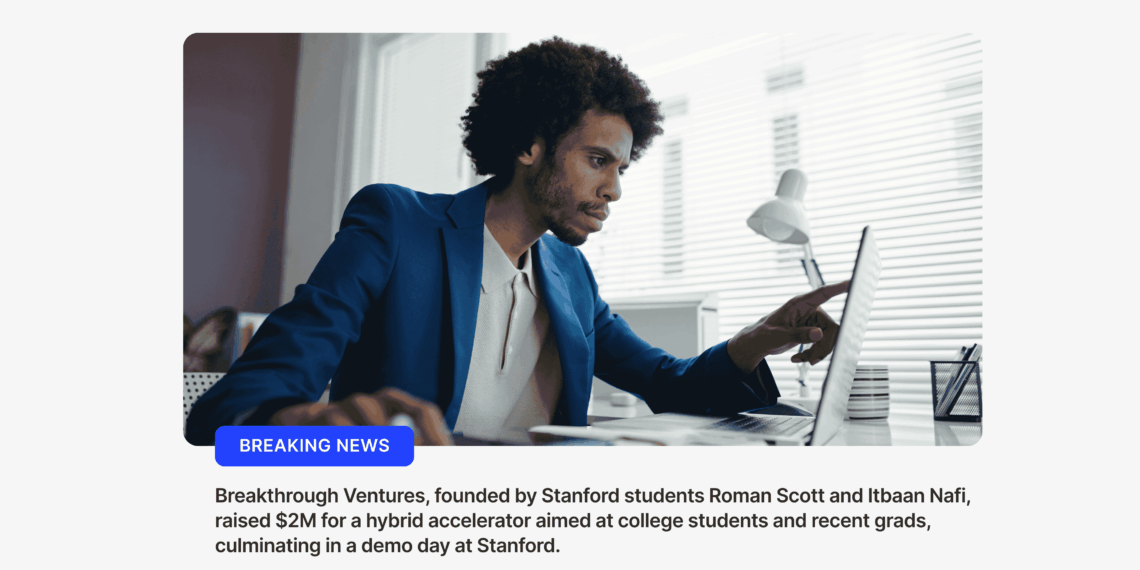

U.S. startup accelerators get a new student pipeline: Breakthrough Ventures

Breakthrough Ventures, founded by Stanford students Roman Scott and Itbaan Nafi, raised $2M for a hybrid accelerator aimed at college students and recent grads, culminating in a demo day at Stanford.

- Key detail: up to $10k in grant funding, compute credits via Microsoft and NVIDIA Inception, plus legal support/mentorship and a possible $50k follow-on.

If you’re trying to stretch runway with compute, start here: Microsoft Azure Credits for Startups | Save up to $150K - Why it matters: it targets the two student-founder choke points (cash + networks) without a full relocation.

- What to watch: whether the follow-on becomes a real conversion rate and how broad the VC-host meetup circuit gets.

YC makes the funding rail optional, not the terms

Y Combinator says accepted startups will soon have the option to receive their seed checks via stablecoins, starting with the Spring 2026 batch, with reporting pointing to USDC and support across Base/Solana/Ethereum.

- Key detail: YC’s standard deal remains $500,000 on standard terms; only the delivery rail changes. (YC deal terms)

- Why it matters: faster settlement can reduce friction for distributed teams, but it also drags treasury/compliance decisions earlier.

- What to watch: whether other accelerators copy the “choose-your-rail” option as a default perk.

Morgan Stanley’s MSISV turns demo day into a distribution claim

Morgan Stanley hosted its annual Inclusive & Sustainable Ventures (MSISV) demo day and opened applications for the next cohort, saying companies pitch 300+ investors and that the last five months included 29 startups and 4 nonprofits. (Morgan Stanley)

- Key detail: applications are open through March 31, 2026, with the cohort launching later this year.

- Why it matters: impact accelerators rarely quantify distribution; MSISV is putting a number on the room.

- What to watch: whether that “customer + partner” exposure shows up as pilots, not just meetings.

U.S. startup accelerators go scale-stage: LearnLaunch opens 2026

LearnLaunch opened applications for its Boston-based Breakthrough to Scale program for edtech startups with product and revenue, pitching a mostly-remote format plus a week on-site. (Program details)

- Key detail: $50k initial investment on acceptance, with milestone-based follow-on funding later.

- Why it matters: the program is explicit about time demands and stage fit, useful if you’re already selling into slow procurement cycles.

- What to watch: LearnLaunch says applications run through March 20, 2026 and require an info webinar (per its public posting).

A new $50M pool for post-program seed: SNAK Venture Partners

SNAK Venture Partners closed an oversubscribed $50M debut fund, anchored by Pritzker Group, to back vertical and B2B marketplaces; it says it has already invested in six companies. (TechCrunch)

- Key detail: target checks are $1M–$2M into 20+ companies over 3–4 years.

- Why it matters: founders get concrete outreach math, check size, pace, and thesis, right when many accelerator grads start fundraising.

- What to watch: whether “marketplace” bets tilt toward fintech-heavy models (harder, but potentially stickier).

This week’s signal

More U.S. startup accelerators are making it cheaper and faster to ship a real prototype, especially for students and first-time founders, by bundling cash, compute credits, and clearer paths to a first check.

What to Watch Next

- Stablecoin funding rails spreading beyond YC.

- More hybrid programs that borrow elite demo-day distribution without requiring a move.

- Seed funds narrowing theses and publishing check-size ranges.

Applying this quarter? Use a fit-first shortlist: Startup Accelerators in 2026: The Smart Way to Apply.”

Top Tech News This Week: don’t miss the next issue.

If you’re picking between U.S. startup accelerators, treat perks like product specs: what arrives when, on what rail, with what follow-on path, and who’s actually in the room when you pitch.

In the meantime, explore Xraise Accelerators and the Perks Hub. If you’re early-stage, the fastest upgrades are often non-dilutive: program access, tooling credits, and warm intros, not another deck rewrite.