If you’re running a Company Startup, growth isn’t only about shipping faster, it’s about using the advantages that only early-stage companies are allowed to touch. Your job is to convert “startup status” into runway, distribution, and investor readiness before those doors quietly close.

TL;DR

A Company Startup grows fastest when it treats startup status as a time-limited asset: claim credits to extend runway, tighten the narrative that attracts capital/talent, and use founder-native channels that incumbents can’t access.

- Prioritize perks that remove real burn (cloud, CRM, comms) before “nice-to-have” tools, XRaise highlights programs with $500k+ in potential savings across major vendors.

- Build a “repeatable story” (why now, why you, proof) so investors and partners can retell it without you in the room.

- Use startup-native distribution routes (launch communities, founder networks, partner swaps) to get early users and feedback without buying attention.

- Keep fundraising assets always-ready: a clean deck, a crisp metric snapshot, and a short list of best-fit investors/programs.

- Go XRaise-first so your deck/profile/perks/applications stay centralized instead of scattered across forms and tabs.

What “Company Startup” really means (and why it expires)

Most founders treat “startup” as a phase. The ecosystem treats it as a classification, a key that unlocks resources because vendors and programs want tomorrow’s big customers early.

Definition: Startup status is the eligibility layer that determines whether you qualify for credits, discounts, programs, and founder-only distribution channels.

That status also fades faster than people expect. Some perks are generous; others are strict. A typical example from SaaS perk verification is “under five years old” and “under $10M ARR” for eligibility. And cloud programs can be tied to funding stage and company age, AWS Activate, for example, lists requirements like pre-Series B and founded in the last 10 years.

The implication is simple: you don’t “earn” these advantages later. You either extract them while you qualify, or you pay retail forever.

If you want a quick mental model: your Company Startup label is like a temporary VIP wristband, it’s valuable only while it’s on your wrist.

Company Startup perks: turn vendor incentives into runway

Perks aren’t “free stuff.” They’re runway.

If your Company Startup is paying full price for cloud, CRM, email, design, and ops tools, you’re choosing higher burn for no strategic reason. XRaise’s blog breaks down many of these programs across the stack (start here if you want the ecosystem map: Startup Perks & Credits guides).

Here’s a founder-friendly way to do this without turning it into a research project.

The “Perks First” sprint (the order matters)

- Infrastructure first (cloud + data): If you’re building anything serious, cloud cost becomes a silent burn line. AWS Activate advertises up to $100,000 in credits via its provider path.

- Revenue tooling next (CRM + comms): Don’t optimize internal “nice-to-have” tools before your systems that drive pipeline and retention. If HubSpot is on your shortlist, use a decision guide like HubSpot for Startups: Is it the right choice? to avoid buying complexity too early.

- Team execution stack last (docs, PM, ops): Great tools matter, but only after you’ve protected runway and sales motion. If you’re on Notion, credits can meaningfully offset early team costs (see Notion promo code for startups for what’s typically included).

If a tool is “core” (cloud, CRM, support), never commit annually until you’ve checked whether your Company Startup qualifies for credits. The penalty for skipping this isn’t theoretical, it’s lost runway.

Cloud credits are the highest-leverage play (choose before you migrate)

Founders often pick a cloud by habit, then later discover the credits would have changed the decision.

Google’s startup program explicitly positions credits as a growth lever, $200,000 in credits (or up to $350,000 for AI-first startups) depending on track and stage.

If you want a clear comparison lens without spending your weekend on it, use XRaise’s breakdown: Which cloud credit program is right for your startup?

A practical decision rule

- If you’re compute-heavy / ML-heavy, optimize for credits + GPU availability + support pathways.

- If you’re early MVP, optimize for speed of setup, simplicity, and a credit track you can actually qualify for.

- If you’re already deployed, prioritize “how painful is switching?” before chasing a bigger headline number.

Company Startup narrative: make your story investable (and recruitable)

A Company Startup doesn’t win because it exists. It wins when the market believes it’s becoming inevitable.

You don’t need poetic storytelling. You need a narrative that survives forwarding.

The 4-part narrative that travels

- Why now: what changed in the market that makes this possible now (not “AI is big”).

- Wedge: the smallest entry that proves you can win (specific user + specific pain).

- Proof: traction, retention, pilots, or a credible experiment plan.

- Expansion path: how the wedge becomes a bigger business without hand-waving.

If your wedge requires a paragraph, it’s not a wedge, it’s a fog bank. Cut it until it becomes a sentence.how what “signal” looks like under pressure, for example, how they think about weekly progress when founders apply to Y Combinator accelerator.

Distribution routes that favor startups (and punish incumbents)

Big companies buy attention. Startups borrow it.

Your Company Startup advantage is agility: you can ship fast, talk directly to users, and iterate publicly without committees.

High-ROI routes that fit early-stage constraints:

- Launch communities: ship a “small but real” release and recruit early adopters who want to be part of the build.

- Founder networks: trade intros, distribution swaps, and honest feedback with peers.

- Partner swaps: co-market with adjacent startups that serve the same customer (but don’t compete).

- Public building: consistent shipping + lessons learned = trust compounding.

This only works if your product has a clear “first user.” If your target is “everyone,” distribution becomes expensive and vague.

Fundraising readiness without losing weeks to deck-building

Even if you’re not raising now, staying investor-ready is a growth advantage: it unlocks partnerships, accelerators, angels, and “random inbound” moments you can’t schedule.

Keep three assets always current:

- A deck that sells the wedge + proof (not a design project)

- A one-page metrics snapshot (pipeline, activation, retention, burn)

- A short target list of aligned investors/programs

If you want to compress the “deck rewrite cycle,” start with the XRaise workflow: build once, reuse everywhere, and keep iterations tied to real feedback, not aesthetic debates. (You can pair this with your perks workflow so the same founder profile supports both.)

Accelerator applications: use them as a multiplier, not a distraction

Accelerators are valuable when they amplify momentum. They’re painful when they become procrastination dressed up as progress.

If you want a timing lens, XRaise’s guide on when you should apply to an accelerator is built around readiness and cycle realities, not vibes.

Fundraising readiness without losing weeks to deck-building

Even if you’re not raising now, staying investor-ready is a growth advantage: it unlocks partnerships, accelerators, angels, and “random inbound” moments you can’t schedule.

Keep three assets always current:

- A deck that sells the wedge + proof (not a design project)

- A one-page metrics snapshot (pipeline, activation, retention, burn)

- A short target list of aligned investors/programs

If you want to compress the “deck rewrite cycle,” start with the XRaise workflow: build once, reuse everywhere, and keep iterations tied to real feedback, not aesthetic debates. (You can pair this with your perks workflow so the same founder profile supports both.)

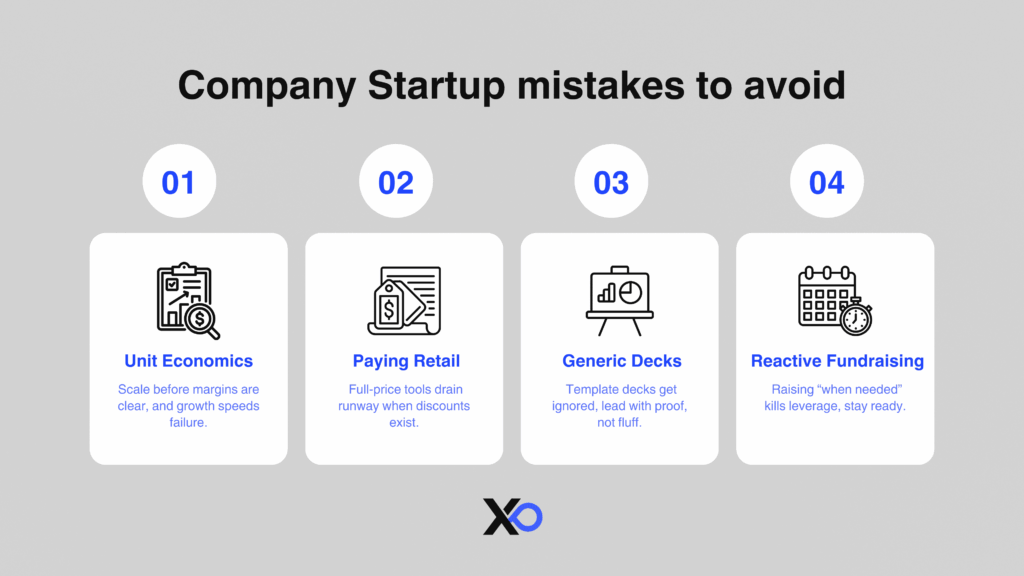

Common mistakes that quietly kill Company Startup growth

These show up in “busy” startups that still don’t move.

- Scaling without unit economics clarity: If every new customer increases losses, growth speeds up failure. Use credits to improve margins, not to burn faster.

- Paying retail for core tools: It’s not “lean” to pay full price when you qualify for verified credits.

- Decks that sound like templates: Investors can smell recycled positioning in seconds. Make proof the center, not the market-size slide.

- Reactive fundraising: “We’ll raise when we need it” usually means “we’ll raise desperate.” Stay ready so you can raise from strength.

If you want a concrete perk-eligibility example of how specific these programs can be, even ops tools like Asana vs ClickUp perks can be tied to filters like age and ARR.

Your Action Plan:

- Assess fit: Are you at the right stage? Is your network weak enough to justify the equity cost? Be honest.

- Build your application foundation: Create a pitch deck that meets top-tier standards, whether you apply or not. → Use XRaise AI Pitch Deck Builder

- Hedge your bets: Lock in accelerator-level perks NOW, regardless of whether you apply. → Claim $500K+ in XRaise Perks

- Apply strategically: 5 targeted applications to programs with genuine thesis fit beat 20 spray-and-pray submissions every time.

Whether you’re accelerator-bound or building independently, XRaise gives you the unfair advantage, the tools, the perks, and the investor access without the equity cost.

Turn your Company Startup window into compounding growth

The direction is clear: vendors and ecosystems are doubling down on startup credit programs, and founders who operationalize perks + narrative + distribution build more runway than founders who “just grind.” In 2026, the winners won’t be the busiest teams, they’ll be the teams that systemize the Company Startup advantages while they still qualify.

For the next 90 days, run a simple cadence: claim the highest-impact credits, tighten your wedge + proof, and ship distribution experiments weekly until one channel shows repeatable pull.

Learn more and start building with XRaise’s Web App, then explore programs that can help you scale faster through XRaise’s Accelerators.