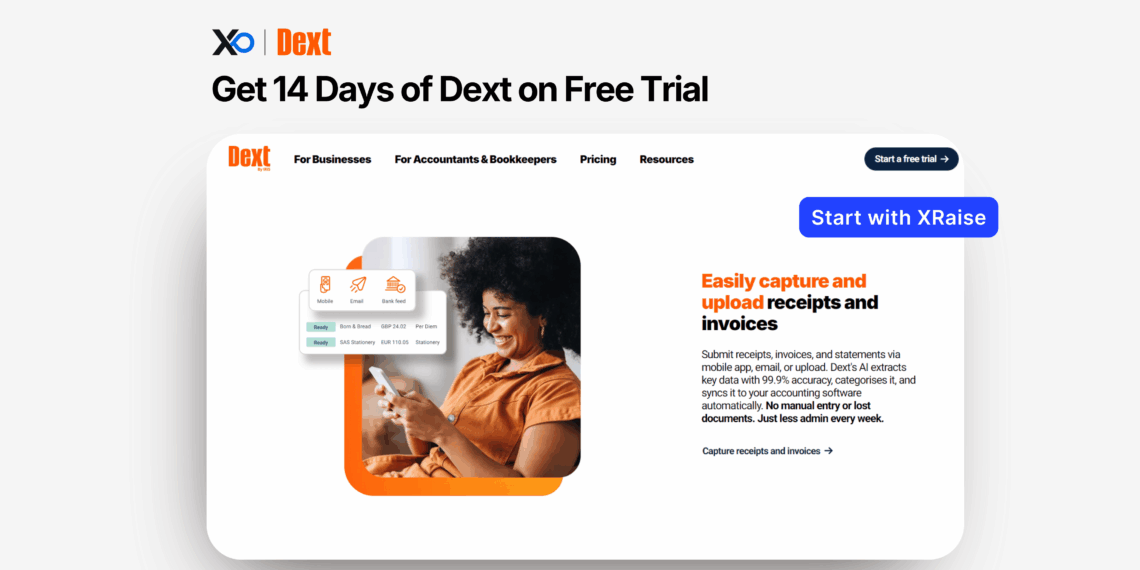

The Dext for Startups perk gives founders a 14-day free trial to test AI-powered bookkeeping prep. Use this perk to reduce receipt and invoice admin without changing your accounting system.

TL;DR

This guide explains how the Dext for Startups perk works, so you can streamline receipt and invoice prep without locking into a subscription too early.

- Validate the workflow fast: a 14-day free trial with no credit card, so you can test before you pay.

- Capture documents in one place: submit via mobile, email, or drag-and-drop, so receipts don’t vanish in inboxes.

- Keep your stack stable: use Dext with accounting integrations and bank connections instead of switching tools mid-close.

- Use XRaise to claim the perk and keep your perks stack organized, apply on XRaise, then check the official vendor page only for details/terms.

What is the Dext for Startups perk and why it matters

The Dext for Startups perk gives you a free 14-day window to test Dext in a real workflow. Dext focuses on “pre-accounting” work. It captures receipts and invoices, extracts key details, and pushes clean data into your accounting tools.

This matters because most finance chaos starts before bookkeeping. Documents sit in inboxes. Someone forgets to forward a PDF. Then month-end turns into a hunt.

If you treat perks as runway tools, pair this with a broader stack audit. This guide on startup resources for business startups helps you spot savings across your tool stack.

What the Dext for Startups perk includes

Here’s what you get with the Dext for Startups perk:

- Free 14-day trial to evaluate the product.

- No credit card required to start the trial.

- Receipt and invoice capture by mobile app, email, or upload.

- Automated data extraction from those documents.

- Integrations with accounting software and connections to 11,500+ banks and institutions (as stated by Dext).

What the Dext for Startups perk does not include

The Dext for Startups perk covers the trial. It does not publicly guarantee:

- A post-trial discount or credits.

- A specific plan level after the trial. (Plans vary by region and needs.)

If you need full terms, use the vendor’s official trial details. Official Dext page

How the Dext for Startups perk works in practice

You will get value from the Dext for Startups perk when you test it with real documents. Don’t wait for “perfect setup.” Run it against your actual week.

A simple 30-minute setup for the Dext for Startups perk

- Pick one owner (founder or ops).

- Choose your capture rules. Decide what goes into Dext.

- Connect your accounting tool. Keep the system you already use.

Keep it simple. You want a clear before-and-after.

Week 1: Fix intake, not accounting

Use the Dext for Startups perk to centralize capture first.

- Snap paper receipts with the mobile app.

- Forward emailed invoices into your capture flow.

- Drag-and-drop PDFs when vendors send portals or downloads.

Your goal: fewer missing documents. That alone speeds up close.

Week 2: Run a mini close rehearsal

Now test the downstream value.

- Review extracted fields for accuracy.

- Confirm categories match how you report spend.

- Sync or export into your accounting system.

If you use QuickBooks or Xero, you can keep learning inside the same cluster:

Eligibility and how to maximize the Dext for Startups perk

The perk gives a free trial, so you can test without procurement friction. Dext states the trial runs for 14 days and needs no credit card.

To maximize the Dext for Startups perk, focus on these operator moves:

- Start on a “busy” week. Test when invoices and expenses flow in.

- Standardize team behavior. Pick one rule: “Send receipts to Dext the same day.”

- Reduce tool sprawl. Don’t add a second capture tool during the trial.

- Measure time saved. Track how long you spend on document chasing now.

Plans and pricing context for the Dext for Startups perk

Keep this part simple. The Dext for Startups perk gives a trial. After the trial, Dext says you can pick a subscription. If you do not upgrade, Dext says it pauses the account and charges nothing.

For plan details, use official pricing information.

Who should use the Dext for Startups perk

The Dext for Startups perk fits best when document volume creates real drag.

Use it if you are:

- A founder doing finance admin between product pushes.

- An ops lead who manages receipts and invoices for a small team.

- A team that wants faster bookkeeping prep without switching accounting software.

Skip it (for now) if you are:

- Pre-revenue with low spend and few vendors.

- Already running a tight flow with a bookkeeper and a stable process.

Alternatives to the Dext for Startups perk

If your main problem is capture and pre-accounting, Dext makes sense. If your main problem is approvals and payables, you may want an AP-first tool.

A nearby internal read: BILL promo code for startups

You can also compare accounting platforms if that is your real blocker:

FAQ

How long is the Dext for Startups perk trial?

It lasts 14 days.

Do I need a credit card for the Dext for Startups perk?

No. Dext states you can start the trial without a credit card.

What happens after the Dext for Startups perk trial ends?

Dext says you can choose a subscription. If you do not upgrade, Dext pauses the account and charges nothing.

Can Dext work with my current accounting tools?

Dext states it supports accounting software integrations and connects to 11,500+ banks and institutions.

Final thoughts

The Dext for Startups perk works best when you test it on real receipts and invoices. Use the 14 days to prove one thing: you spend less time chasing documents. If that happens, your close gets easier.